Cost of Living in Portugal

How to move

In order to retire in Portugal, you will need apply for residency. The process may take sometime but it is straightforward. The application requires you to provide a passport, proof that you have regular income and proof that you have health insurance. You will also need to submit to a criminal background check.

State Pensions

There is a means-tested social pension for those who haven’t made sufficient contributions. This may or may not apply to you.

Death

If you die in Portugal, the country’s inheritance laws dictate that the inheritance process used in your home country should apply. For example, if you retire in Portugal from the UK, then UK inheritance laws will apply. Portugal doesn’t impose an inheritance tax on property. Instead, stamp duty is payable by some beneficiaries, however, spouses and descendants are exempt.

NHR no longer applicable

It was announced that the Non-Habitual Resident (NHR) tax regime was coming to an end as of January 2023. The new NHR regime focuses on employment. This excludes pension income and therefore will no longer be beneficial for retirees. For example, your foreign pension income will no longer be taxed at the reduced 10%.

Cost of Living Albufeira

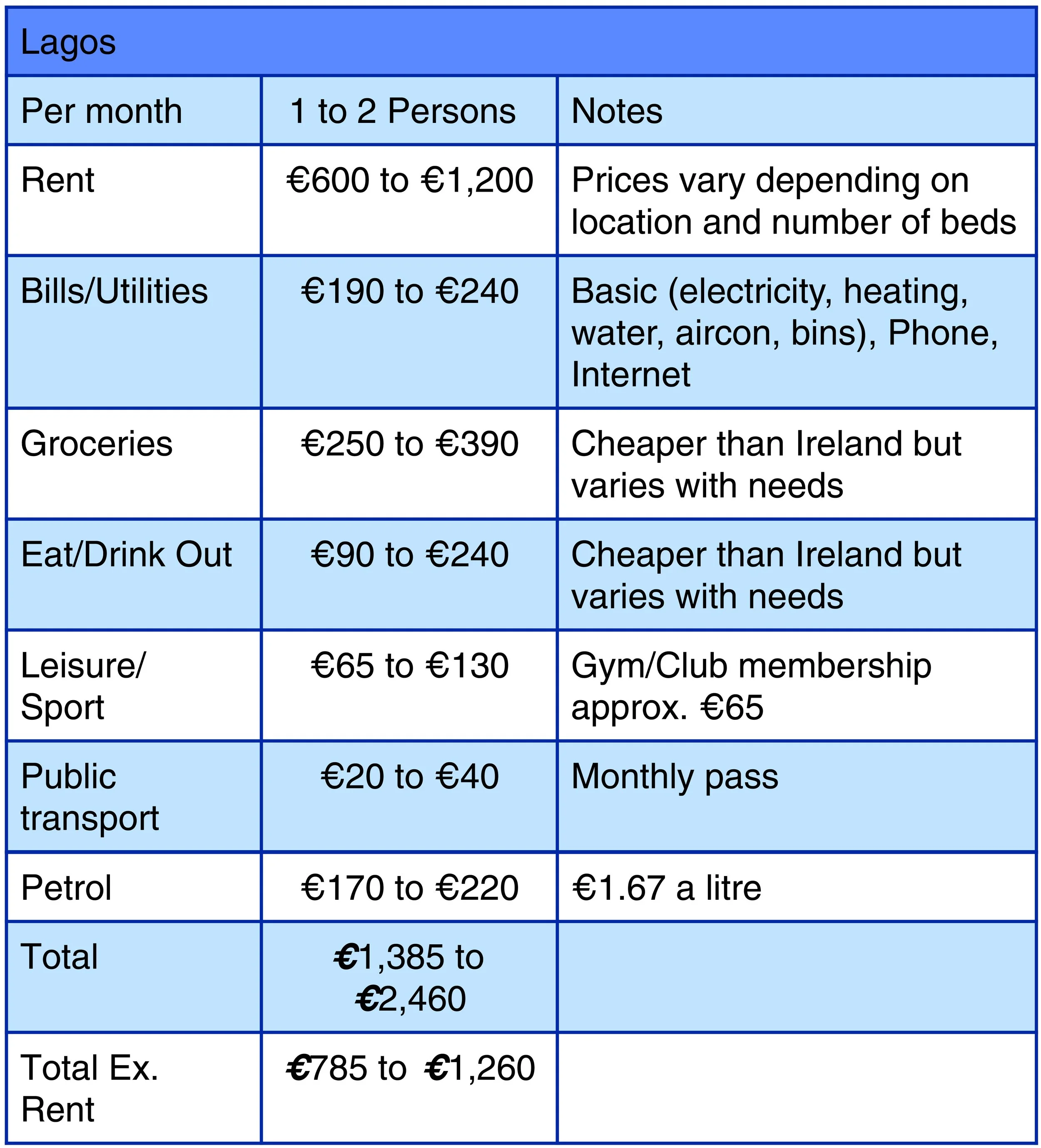

Cost of Living Lagos

Cost of Living Portimao

Potential once off payments

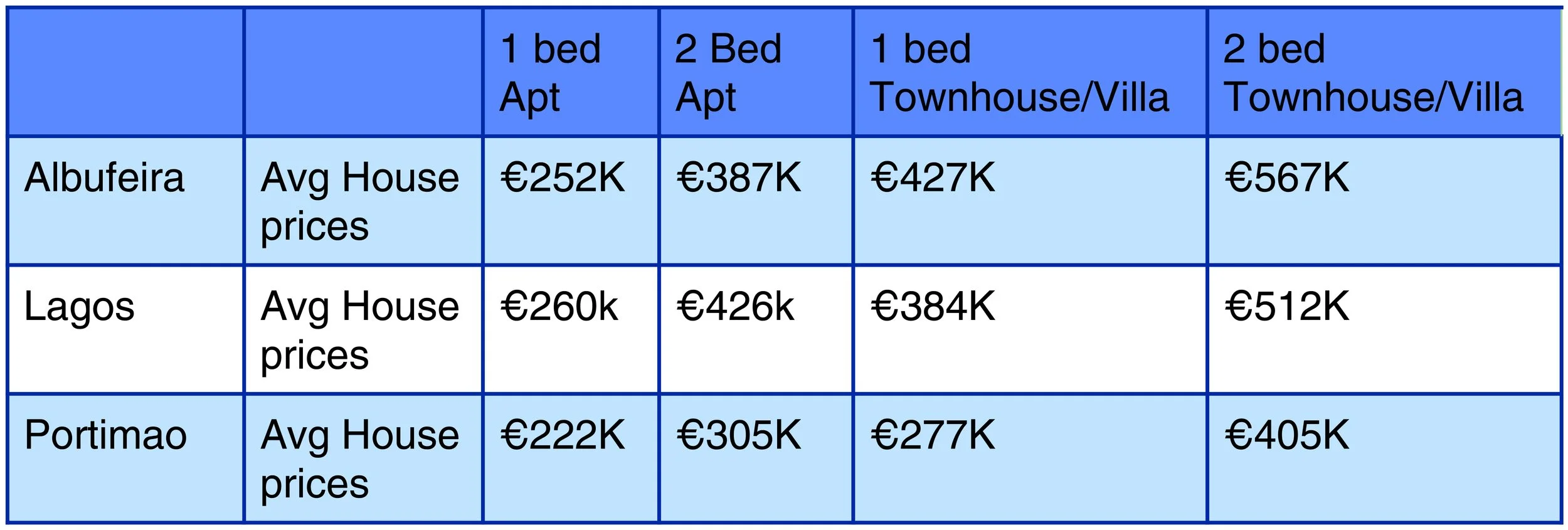

House prices vary depending on location, whether the property is in the city centre or on the outskirts.

New Car can cost €7k to €35k plus.